tax benefit rule definition and examples

This rule generally restates 145. The business mileage rate for 2022 is 585 cents per mile.

Section 80ee Deduction For Interest On Home Loan Tax2win

You may use this rate to reimburse an employee for business use of a personal vehicle and under certain conditions you may use the rate under the cents-per-mile rule to value the personal use of a vehicle you provide to an employee.

. This information will be used by the IRS to substantiate claims for tax benefits. The proposed regulations provide two examples that illustrate the definition of highway vehicle. This information is required to obtain a tax benefit and meet a taxpayers recordkeeping obligations under section 6001.

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Charitable Contributions Tax Breaks And Limits

Advantages And Disadvantages Of Trial Balance Trial Balance Accounting Basics Accounting Principles

When To Use Comma Essay Writing Skills Learn English Grammar Comma Rules

Gross Rental Income Rental Income Buying A Rental Property Investing

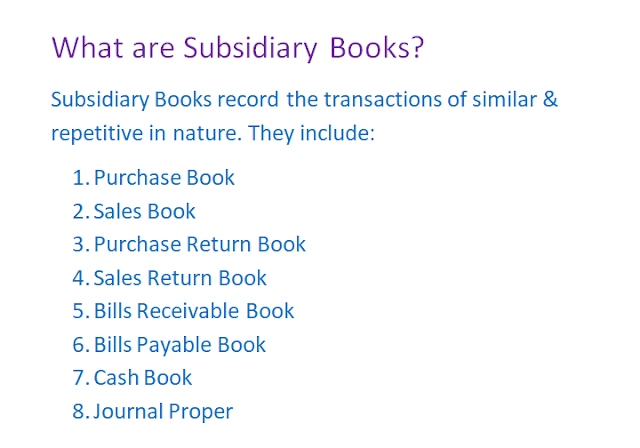

What Are Subsidiary Books And Its Types Profit And Loss Statement Cash Flow Statement Book Meaning

Taxes The Norwegian Tax Administration

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Income Tax It Returns Rules What Is Income Tax For Fy 2021 22

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Tax Benefits Of Nps Scheme Deduction Coming Under Section 80ccd 1b Tax2win

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Leave Travel Allowance Lta Claim Rule Eligibility Tax Exemptions

Value Investors Are Not Frequent Traders Valueinvestors Are Focused On The Long Term Whereas Traders Are Fo Investing Investing Strategy Investing In Stocks

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Is The Rule Of 72 A Simple Definition And Examples Rule Of 72 Simple Definition Investing

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center